Invoice Template for Malaysian sole traders

Create professional invoices on-the-go.

Invoicing made easy!

- Invoice Date

- 18.04.2023

- Due Date

- 02.05.2023

- Amount Due

- 7,860.45 RM

I2023042717

Customer No.

66392636

33 Arch Street

Kuala Lumpur 50050

Malaysia

56 Harrison Avenue

Kuala Lumpur 50050

Malaysia

| Description | Qty | Tax | Price | Amount |

|---|---|---|---|---|

|

Item 1

|

8 |

✓

|

926.94 | 7,415.52 |

| Subtotal | 7,415.52 | |||

| Ust (6.00%) | 444.93 | |||

|

Total

MYR

|

7,860.45 | |||

Paymen Instructions

Bank Negara Malaysia

WeTrade PLT

XX37 8597 6909 7440 3941

Contact Details

E.Knight

Tel.: +60 201359340

Mail: e.knight@wetrade.com

How to generate invoices using YoInvoice

Why YoInvoice is the best option

Invoice in 20 seconds

Simple and free, no need to register. Create a professional looking invoices in less than 20 seconds.

Beautiful templates

Professional, creative, or fun, it's all up to you. Select from 100+ invoice templates in our library, or customise your own.

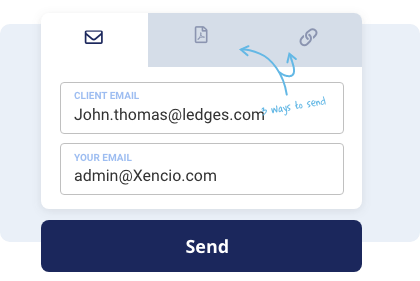

Email to your client

Email the invoice to your client directly, they will receive the link to the digital cloud as well as a downloadable PDF file

Get paid faster

Invoices with Credit Card or QR code payment options are 50% more likely to be paid on time, and in most cases, paid right away. Accepting online payment is just a click away with YoInvoice

Check out other features

What do I need for my invoice for Malaysia?

SST and Tax requirements

- Electronic / hard copy

- Electronic

- SST threshold

- 500,000.00 RM

- Register procedure

- Online

Mandatory

- Client address

- Gross value

- Client name

- Client tax number

- Company contact details

- Supplier Signature

- Company address

- Invoice number

- Due date

- Company logo

- Issue date

Optional

- Product desc

- Tax rate

- Company name

- Net amount

- Tax amount

What are you invoicing?

Popular service / product item for sole traders

Select the relevant service / product item you would like to use to create your first invoice